How can impact investment address the multi-million dollar financing gap in the water sector?

Published on: 07/11/2017

A notable group of economists, impact investors, utility managers, entrepreneurs and water specialists met at the Amsterdam International Water Week last week to discuss this.

Impact investing is known as investments made with the objective of producing social, economic and/or environmental impact while having returns on the investment. However, this does not mean that it has to be a financial return. The latest data from the Global Impact Investing Network shows that for impact investors, the water and sanitation sector scores lower than renewable energy (which is not surprising), but also lower than climate actions and gender equality programmes.

Participants in the session agreed that the benefits of investing in the water and sanitation sector, and the direct impact that it has on all other SDGs, will bring more impact investors into the sector in the coming years. However, there are no clear financing mechanisms in place that can make it easier to match the interests and conditions requested by private finance companies and "match-makers" with the entrepreneurs that need the money.

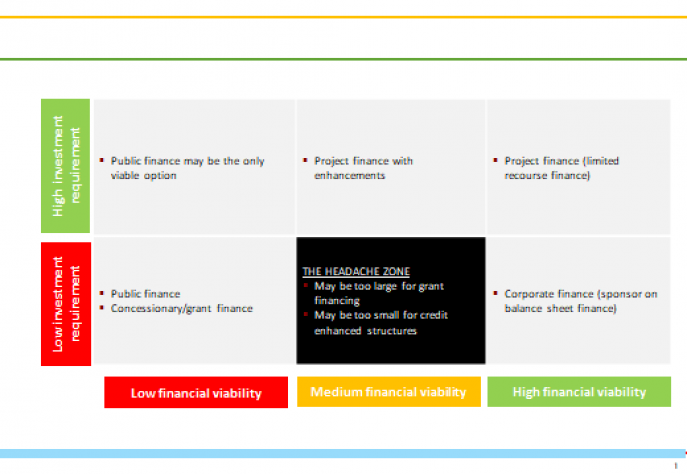

Joseph Murabula, Chief Executive Officer of the Kenya Innovative Finance Facility for Water, considered that impact investors are keen to finance the development phase of water projects as they are able to take the highest risks, define problems, ensure that the projects are viable, and do the modelling and structuring for making projects ready to attract commercial finance. According to Murabula, the main "headache zone" for financing is when there is a lower investment requirement and medium financial viability (see Figure below).

For Jacqueline Barendse, Director of WASTE, financing water projects is currently a real puzzle as it is difficult to match financing with business models that usually do not go to scale. It is not really a question of capital. Money is there but it is difficult to access funding as impact investors are all very different from each other and all request different measurements of impact. Barendse conceived outcome models as a distinctive approach to this subject. She explained that there is a need to monetise impact by capturing the value (social costs and benefits) of WASH projects. WASH projects should allow to be measured by their own metrics. For example, either more conventionally by tracking the amount of toilets built or less so, by monetising the savings from time spent collecting water.

Jeroen Blüm, Founder of BIX Fund Management BV, also considered that externalities (referred to as the impacts of the projects) do have a clear value for society. For him monetising the value of WASH projects means finding governments, businesses and individuals willing to pay for externalities so that households at the base of the pyramid can improve their health and access to services while also contributing to a positive change in the environment and creating more space for economic growth.

For impact investors that are currently exploring the water sector, represented in this session by Peter Heijen, CEO and Funder of Lendahand, and Rien Hazeleger, Business Development Specialist at Oikocredit International, it is clear that investing in water is the newest impact opportunity. The big challenge remains the business case, although both Heijen and Hazeleger mentioned that they see models emerging in the sector and impact measurements that will make water investment ready.

For Bill Kingdom, Global Lead for Water Supply and Sanitation at the World Bank, there is a clear need to think beyond the construction of pipes or toilets. For him, it is crucial to consider how the water resource can best be priced and water projects can be more sustainable in the long term. He underlined "increasing impact investing in the sector can only be achieved with improved governance. We need to be able to provide the right incentives for utilities and service providers to become more efficient."

According to Ravi Ninawe, Head of Global Partnerships at WaterHealth International, the role of governance and public finance is critical to contributing to the improvement of lending terms and derisk the water sector. Leveraging soft capital and grants can later be blended with bonds when the size of the finance needed is much larger. However, to achieve this, governments (and service providers) should be fully accountable, something that is still missing in many countries.

There is also limited data about the risk and capacity of water utilities to contract debt. According to David Onyango, Managing Director at Kisumu Water and Sewerage Company, one of the solutions could be to encourage the sector to be fully credit rated so utilities can steadily gain access to financial markets.

All in all, the participants stressed the need to build a solid network and transparency on the financing mechanisms available in which diverse sectors and stakeholders can work together since they recognised that impact investing could be part of the solution but never the whole solution to the current financing water challenge.

At IRC we have strong opinions and we value honest and frank discussion, so you won't be surprised to hear that not all the opinions on this site represent our official policy.